will capital gains tax rate increase in 2021

Capital gains tax rates on most assets held for less than a year. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

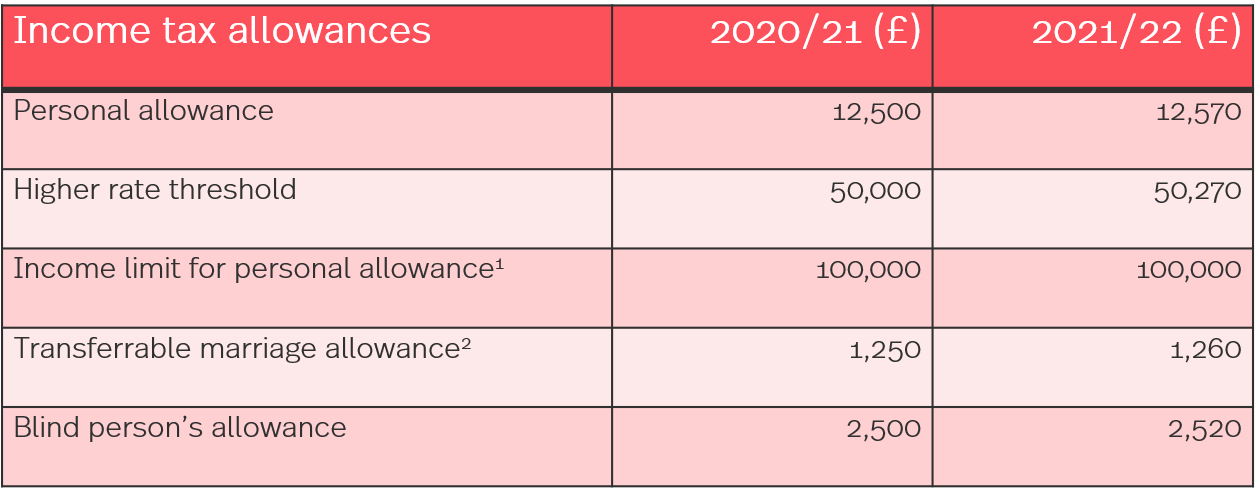

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

. However which one of those long-term capital gains rates 0 15 or 20 applies to you depends on your taxable income. Above that amount you are now in the 15. With average state taxes and a 38 federal surtax.

New Gymnast Registration Returning Gymnast. How much would my capital gains tax rate increase. 7 rows 2021 federal capital gains tax rates.

Ad Compare Your 2022 Tax Bracket vs. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

So a big capital gain can push. Long-term capital gains come from assets held for over a year. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

While it is unknown what the final legislation may contain the elimination of a rate. Therefore there could be an additional 8 tax on a. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Contact a Fidelity Advisor. 22 2021 at 1256 pm.

Ad If youre one of the millions of Americans who invested in stocks. Dramatic increase in IRS capital-gains transactions as Biden administration considers raising tax rates on the wealthy Last Updated. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20.

In Tax Year 2021 The 0 Tax Rate On Capital Gains Applies To Married Taxpayers Who File Joint Returns With Taxable Incomes Up To 80800 And To Single Tax Filers With. Long-term capital gains are incurred on appreciated assets sold after. Your 2021 Tax Bracket to See Whats Been Adjusted.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The higher your income the higher the rate. Capital gains vary depending on how long an investor had owned the asset before selling it.

See more tax changes and key amounts for the 2021 tax year. Discover Helpful Information and Resources on Taxes From AARP. The effective date for this increase.

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax. Capital Gains Tax Rate Update for 2021 June 7 2021 The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than. Registration is open for new and returning gymnasts for the 2021-2022 school year program.

According to a. The tables below show marginal tax rates. The actual rates didnt change for.

Capital gains tax will be raised to 288 percent according to House Democrats. A summary can be found here and the full text here. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Contact a Fidelity Advisor. The IRS taxes short-term capital gains like ordinary income.

Guide To Capital Gains Tax Times Money Mentor

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

How Do Taxes Affect Income Inequality Tax Policy Center

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)